By Rinki Pandey January 27, 2026

The essential requirement for businesses that process card payments and digital payments involves how processing volume impacts their effective rate. Merchants who accept payment through cards and digital payment methods need to comprehend the actual payment costs. Their monthly transaction volume includes the chosen payment processing pricing model. Two businesses with the same processor and rate card can end up paying very different costs simply because their processing volumes differ. Payment processors evaluate merchants based on three criteria, which include risk assessment and operational consistency, and their ability to handle processing volume.

The level of payment processing activities that a business experiences will impact three main areas. This includes interchange qualification and processor profit margins, and the total processing fees that a business incurs. The merchants who experience growing business volumes will achieve access to improved pricing levels. Their blended rates will increase when they experience inconsistent business operations or non-existent business activity. The field of merchant pricing optimization functions as a strategic advantage that exists beyond basic operational requirements.

This guide shows how processing volume impacts your effective rate through practical execution. It explains how changes impact interchange costs, processor markups, fee distribution, and the establishment of pricing power for future periods. Businesses can achieve better decision-making results through dynamic understanding because it drives cost reduction and margin enhancement, stabilizing payment expense patterns.

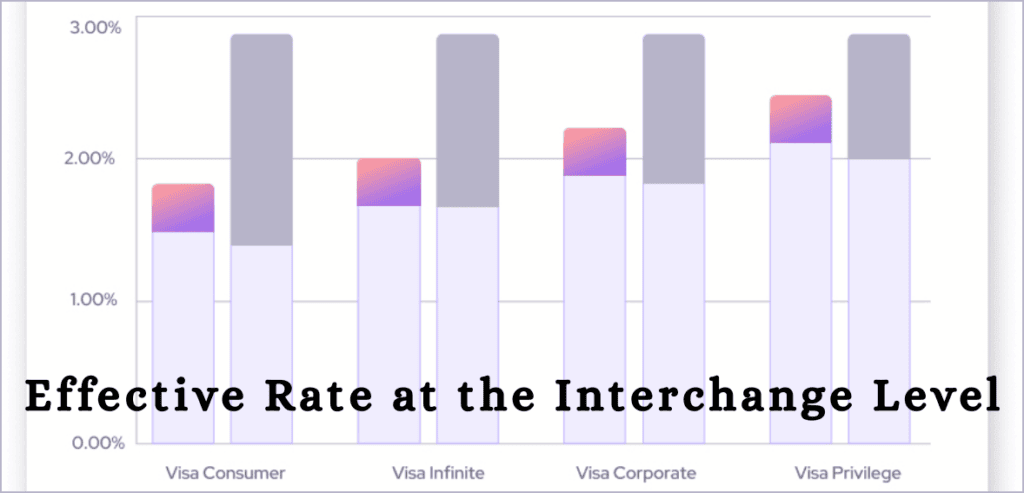

Effective Rate at the Interchange Level

Understanding the effective rate requires an examination of interchange operations. Card networks determine interchange fees, changing according to the transaction type, the card category, and the risk profile of the transaction. Merchants cannot negotiate interchange fees directly because their payment processing volume determines their eligibility for lower interchange rates.

The system achieves better transaction data accuracy with decreased processing volume, which results in fewer payment downgrades. The system processes more payments through its correct qualification system and prevents payments from entering expensive non-qualified status. The processing rate improvement occurs because more transactions reach the effective processing rate despite base interchange rates remaining the same.

Merchants with lower payment volumes face a higher risk of payment downgrades. As they lack essential data, their settlement processes take too long, and their processing methods show irregularities. Interchange efficiency through merchant pricing optimization requires an understanding of how volume stability operates. The system achieves cost savings through volume consistency, and it increases the accuracy of rate predictions.

Impacting Your Effective Rate Through Processor Markups

The calculation of the effective rate through the processor markups serves as the primary method to determine processing costs. Payment processors make their profits through three methods, which include charging per-transaction fees, basis point markups, and their bundled pricing spreads.

Merchants with higher payment processing volume have better negotiating power to secure more advantageous contract terms. Processors show greater willingness to decrease their profit margins when they achieve higher transaction volume, which helps them recover lost income from each transaction. The processing rate that merchants use to calculate their costs increases with each passing year. Merchants who conduct few transactions in their businesses end up paying their processors higher fees because processors need to recover their operational expenses.

Merchant pricing optimization requires merchants to conduct pricing reviews and schedule them according to their projected volume increases. Merchants should examine their pricing agreements because processor markups need to match their current business activities instead of using outdated estimates.

Tiered Pricing Models

The tiered pricing system demonstrates how processing volume affects your effective rate through its hidden operational effects. This system classifies transactions into three tiers, which receive different pricing rates for qualified transactions, mid-qualified transactions, and non-qualified transactions.

Higher payment processing volume can reduce the percentage of transactions falling into expensive tiers when systems and workflows improve. The true expenses of tiered pricing remain hidden, which prevents organizations from assessing their actual volume-based operational growth. Lower-volume merchants may experience higher effective processing rates because a few downgraded transactions can significantly skew averages.

Merchant pricing optimization becomes difficult when tier definitions are unclear. Volume growth does not deliver cost savings because pricing transparency needs to improve with it.

Volume Impacts Under Interchange-Plus Pricing

The interchange-plus pricing system shows merchants their exact effective rate based on their processing volume. The pricing model requires merchants to pay both the interchange fee and a fixed fee charged by the payment processor. As payment processing volume increases, the markup becomes the primary area for optimization.

Higher volume spreads fixed monthly fees across more transactions, lowering the effective processing rate. The process also improves our ability to negotiate when we enter into contract negotiations for renewal. The blended rate increase occurs because lower-volume merchants experience fixed costs at a higher intensity.

Merchant pricing optimization is most effective under interchange-plus because volume changes are easier to analyze. Businesses can track how growth directly lowers per-transaction costs and improves overall efficiency.

Processing Fixed Fees

The evaluation of the effective rate becomes problematic because people neglect to consider fixed fees. The volume of transactions determines how monthly account fees, PCI fees, gateway charges, and statement fees impact merchants.

High-volume merchants experience fixed fees as only a minor expense that they need to pay. The same charges that apply to high-volume businesses cause low-volume companies to pay higher effective processing costs. Payment processing volume functions as the main element that businesses use to analyze their expenses.

Businesses need to conduct routine audits of their fixed fees to achieve optimal pricing results. Businesses need to assess their volume growth because it requires them to stop spending money on outdated services and unnecessary equipment, which creates extra expenses.

Seasonal Fluctuations

The processing volume of your business determines your effective rate, which varies with seasonal patterns. Businesses that experience changes in payment processing volume will face pricing fluctuations during periods of reduced activity.

The company experiences higher operational expenses because fixed charges stay the same while its transaction volume decreases. The processors will examine sudden changes in volume patterns, considering them to be potential risks. This could lead to temporary changes in their pricing and funding processes.

The process of merchant pricing optimization needs seasonal planning to determine upcoming volume changes, which will guide merchants in establishing their pricing standards. Businesses that maintain regular contact with their processors during known seasonal changes will experience fewer unexpected events. Which helps them maintain stable, effective rates throughout the entire year.

Volume Impacts Small Businesses in Effective Rate

The processing volume of small businesses shows a greater impact on their effective rate than it does for large enterprises. The ability to negotiate decreases when businesses process fewer payments because fixed fees and downgrades become more sensitive to their costs.

Small merchants can achieve better pricing results through two methods, which involve them either enhancing their transaction quality or selecting clear pricing systems while they work on reducing chargebacks.

The merchant pricing optimization process for small companies targets operational efficiency as its main goal instead of pursuing business growth through increased volume. The effective processing rate will decrease over time through minor improvements, which become more significant as volume increases.

Impacting High-Volume Merchants

High-volume merchants achieve their greatest advantages when they discover the link between processing volume and effective rate. Businesses with high transaction volumes gain benefits because they can negotiate better terms, which include special pricing and reduced costs from their payment processors.

Businesses need to achieve more than just meeting volume requirements because volume does not provide sufficient results. Organizations lose their volume benefits when they experience either poor transaction quality or high dispute rates, or when they do not follow consistent settlement procedures.

Organizations need to combine their payment processing volume with their ability to maintain strong operational control. The process of optimizing merchant pricing for large operations requires ongoing audits and competitive bidding, while performance benchmarks help maintain pricing accuracy according to actual transaction volumes.

Processing Volume Through Risk Assessment

The processing volume impacts your effective rate through its risk assessment method. Processors evaluate volume consistency, average ticket size, and growth patterns to assess risk.

Unexplained sudden volume increases will result in higher reserve requirements or pricing changes. The payment processing industry establishes trust through its stable payment processing patterns, which lead to better pricing arrangements.

The process of merchant pricing optimization requires businesses to proactively communicate their growth, promotional activities, and business changes, which helps them avoid cost increases that result from risk-based assessments.

Expanding Payment Methods with Effective Rate

The implementation of new payment methods modifies the relationship between processing volume and your effective rate. The various payment methods establish their distinct interchange plus costs and acceptance fees. The blended rates fluctuate according to the volume distribution between cards, wallets, and alternative payment methods.

The increased volume of payment processing enables merchants to provide more affordable payment solutions, which leads to reduced total expenses. The process of merchant pricing optimization enables businesses to direct clients toward payment methods that optimize efficiency without decreasing their chances of making a purchase. Strategic management of volume diversification enables organizations to achieve better cost control over extended periods.

Effective Rate Through Data Quality

The quality of transaction data determines the impact on the effective rate. The presence of missing or incorrect data leads to higher downgrade risk and increased costs, which remain constant across different volume levels. Data errors have more severe consequences on payment processing systems when the volume of transactions is high.

Hence, their impact becomes more significant when fewer transactions occur. Merchant organizations must spend money on both compliant systems and employee education programs to achieve their pricing optimization goals. Clean data enables merchants to use their volume as an advantage instead of a disadvantage.

Conclusion

The business benefits from understanding how the processing volume affects its effective rate by controlling its payment expenses. The volume of transactions affects four distinct aspects: interchange efficiency and processor markups, fee distribution, and the ability to negotiate. This does not function as an independent factor. It combines the transaction quality and pricing structure. Together with operational discipline, it establishes the connection between growth and either cost reduction or hidden expenses.

Organizations should consider payment processing volume as a valuable strategic resource. Merchants achieve their best pricing outcomes through the combination of transparent pricing models and their ongoing pricing assessments. Through ongoing volume trend tracking and their active efforts to control risks. The companies continue their price negotiations throughout their business expansion process because they want to reduce their operational costs. The companies need to understand volume-based cost changes because this information will help them achieve sustained profitability in competitive markets.

FAQs

What is an effective rate in payment processing?

This is the total percentage a merchant pays in processing fees after all charges are included, known as the effective rate, not just the advertised rate.

How does processing volume affect the effective rate?

Large processing throughput spreads fixed overheads and increases pricing power after some amount of time.

Why do low-volume merchants pay higher effective rates?

Low-volume merchants face higher operational costs because they must pay fixed monthly fees and face higher costs for service downgrades, which results in an increased total effective rate.

Can merchants lower their effective rate without increasing volume?

Yes. Businesses can decrease their effective rate through better transaction processing methods, which result in fewer chargebacks, and they select clear pricing systems.

Which pricing model best reflects the true effective rate?

Interchange-plus pricing shows the clearest breakdown of costs and makes effective rate analysis more accurate.